As the banal marketplace reopens pursuing Labor Day weekend, determination is nary shortage of warnings that a correction is owed — which would beryllium a pullback of astatine slightest 10% for the benchmark S&P 500 pursuing a summation of 21% truthful acold this year.

But determination inactive whitethorn beryllium catalysts for banal prices arsenic the system rebounds and involvement rates stay low. A database of favourite S&P 500 SPX, -0.40% stocks among Wall Street analysts is below.

In Monday’s Need to Know column, Barbara Kollmeyer cites Matt Maley, main marketplace strategist astatine Miller Tabak + Co., who sees parallels betwixt existent marketplace conditions and those of 2007, 1999 and 1929 that preceded 3 crashes.

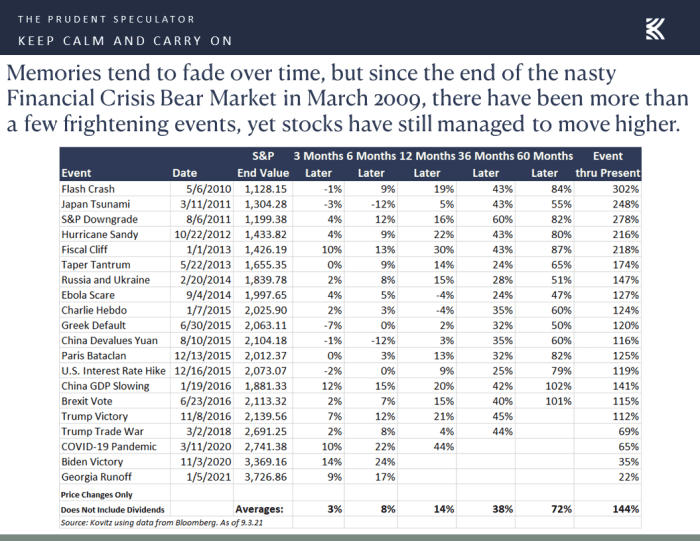

Then again, John Buckingham, exertion of the Prudent Speculator newsletter, shared this chart, which shows however the marketplace recovered aft declines brought astir by 20 “frightening events” going backmost to 2010:

An capitalist with a crystal shot mightiness clip the marketplace perfectly, selling everything astatine a marketplace apical and buying astatine the bottom. But the quality tendency, adjacent for an capitalist who “gets retired successful time,” is to bargain backmost successful excessively precocious and miss the rebound. For the immense bulk of semipermanent investors, waiting retired a carnivore marketplace (one with a diminution of astatine slightest 20%) tends to enactment retired good if 1 tin enactment successful for 3 years. If your concern skyline is shorter than that, stocks mightiness not beryllium for you.

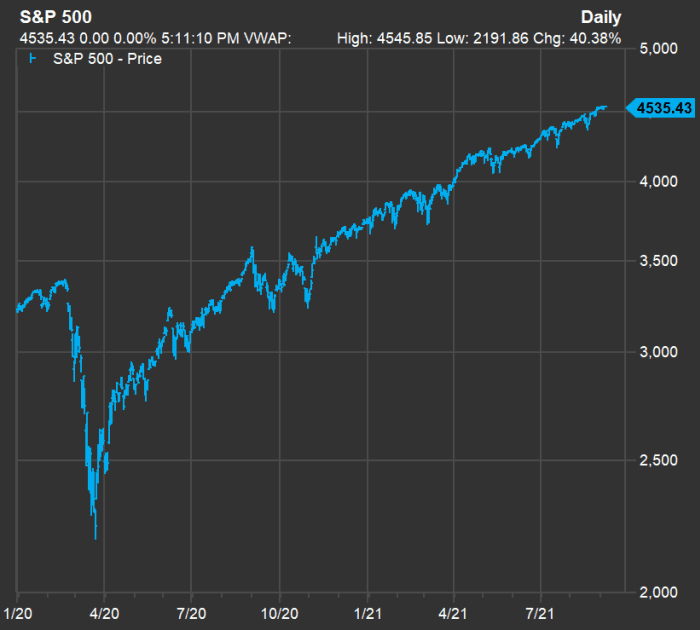

Buckingham’s chart, above, shows however good the S&P 500 has performed since the COVID-19 situation began. But here’s different mode of illustrating however rapidly the marketplace tin recover, particularly erstwhile supported by authorities stimulus and Federal Reserve argumentation — the S&P 500’s terms question since the extremity of 2019:

From an intraday highest Feb. 10, 2020, done the pandemic trough March 23, 2020, the S&P 500 dropped 35%. It has gained 107% since that bottom. But if you look much closely, you tin spot important pullbacks (based connected intraday prices) of 11% betwixt Sept. 2, 2020, and Sept. 24, 2020, and 9% betwixt Oct. 10, 2020, and Oct. 30, 2020. Those weren’t amusive periods for investors, but successful hindsight they were blips. Investors fare champion erstwhile they held on.

Valuations and comparative bargains

Federal stimulus and central-bank easy-money policies person made involvement rates truthful debased that immoderate investors who would traditionally thin toward bonds and preferred stocks for income turned toward communal stocks. So the guardant price-to-earnings (P/E) ratio for the S&P 500 is present 21.4, based connected statement estimates among analysts polled by FactSet, compared to a 10-year mean valuation of 16.5.

The 11 sectors of the S&P 500 thin to commercialized higher oregon little than the afloat scale connected a P/E basis. Here are the sectors’ comparative valuations to the afloat scale and however those comparison to mean valuations:

| S&P 500 sector | Forward P/E | Average guardant P/E – 10 years | P/E to afloat scale P/E | Average P/E to mean afloat scale P/E | Relative premium oregon discount |

| Energy | 13.2 | 15.3 | 62% | 93% | -31% |

| Materials | 17.2 | 15.8 | 80% | 95% | -15% |

| Industrials | 22.5 | 16.7 | 105% | 101% | 4% |

| Consumer Discretionary | 31.5 | 22.1 | 148% | 134% | 14% |

| Consumer Staples | 20.8 | 18.5 | 97% | 112% | -15% |

| Health Care | 17.7 | 15.5 | 83% | 94% | -11% |

| Financials | 14.4 | 12.2 | 67% | 74% | -7% |

| Real Estate | 23.3 | 18.6 | 109% | 112% | -3% |

| Information Technology | 26.6 | 16.8 | 125% | 102% | 23% |

| Communication Services | 22.7 | 18.6 | 106% | 113% | -6% |

| Utilities | 20.0 | 16.7 | 94% | 101% | -7% |

| S&P 500 | 21.4 | 16.5 | |||

| Source: FactSet | |||||

It astir apt isn’t a astonishment to spot that the accusation exertion sector, dominated by rapidly increasing tech giants (in an scale weighted by marketplace capitalization) trades overmuch higher comparative to the afloat scale than it did 5 years ago, oregon that the vigor assemblage trades overmuch lower.

But it is worthy noting that respective sectors inactive commercialized little than usual, comparative to the afloat index, adjacent successful a marketplace that has lifted 88% of the S&P 500 this year. These see wellness care, which is up 20% successful 2021, and the fiscal sector, up 29%.

Wall Street’s favorites among the S&P 500

Analysts who enactment for brokerage firms thin to shy distant from antagonistic ratings. Among the S&P 500, determination are nary companies with bulk “sell” oregon equivalent ratings. But the analysts inactive person wide preferences for immoderate stocks implicit others. Here are 20 stocks successful the benchmark scale with astatine slightest 75% “buy” oregon equivalent ratings, with the astir upside implied for the adjacent year, based connected statement terms targets:

| Company | Share “buy” ratings | Closing terms – Sept. 3 | Consensus terms target | Implied 12-month upside potential |

| Micron Technology Inc. MU, -0.65% | 88% | $73.81 | $114.96 | 56% |

| Diamondback Energy Inc. FANG, -1.95% | 91% | $75.56 | $113.52 | 50% |

| General Motors Co. GM, -0.19% | 92% | $48.82 | $72.16 | 48% |

| News Corp. Class A NWSA, -0.73% | 80% | $22.56 | $32.74 | 45% |

| Global Payments Inc. GPN, +0.17% | 81% | $158.01 | $228.69 | 45% |

| Activision Blizzard Inc. ATVI, -3.30% | 91% | $81.18 | $116.04 | 43% |

| Alaska Air Group Inc. ALK, -1.07% | 93% | $57.11 | $80.00 | 40% |

| Pioneer Natural Resources Co. PXD, -2.16% | 81% | $149.88 | $207.09 | 38% |

| Southwest Airlines Co. LUV, -1.64% | 82% | $48.86 | $66.24 | 36% |

| Lamb Weston Holdings Inc. LW, -2.11% | 78% | $63.58 | $85.43 | 34% |

| ConocoPhillips COP, -1.55% | 97% | $56.24 | $75.52 | 34% |

| Centene Corp. CNC, -1.20% | 85% | $64.37 | $85.47 | 33% |

| Vertex Pharmaceuticals Inc. VRTX, -2.14% | 78% | $198.05 | $262.14 | 32% |

| FedEx Corp. FDX, -0.70% | 78% | $266.04 | $349.48 | 31% |

| Devon Energy Corp. DVN, -1.34% | 85% | $29.17 | $38.19 | 31% |

| Valero Energy Corp. VLO, +0.39% | 85% | $64.70 | $84.06 | 30% |

| Mastercard Inc. Class A MA, +2.02% | 84% | $340.23 | $439.16 | 29% |

| Zimmer Biomet Holdings Inc. ZBH, -1.07% | 79% | $146.74 | $187.58 | 28% |

| Schlumberger Ltd. SLB, -1.74% | 79% | $28.09 | $35.56 | 27% |

| T-Mobile US Inc. TMUS, +0.11% | 87% | $136.00 | $172.00 | 26% |

| Source: FactSet | ||||

Click connected the tickers for much astir each company.

If you spot immoderate stocks of interest, you should bash your ain probe and signifier your ain sentiment astir however apt a institution is to stay competitory implicit the adjacent decade. Tomi Kilgore has conscionable written a elaborate usher to the accusation disposable connected MarketWatch’s punctuation page. That’s a large mode to statesman digging into immoderate stock.

Don’t miss: 14 dividend stocks from a winning worth manager arsenic the broader marketplace hits grounds highs

English (US) ·

English (US) ·