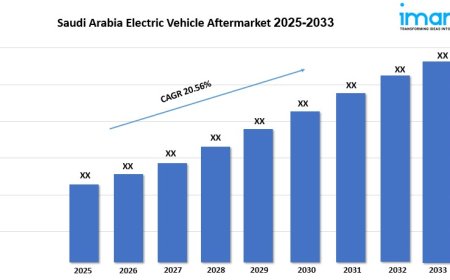

Saudi Arabia Smart Parking Systems Market Trends, Share, Demand and Forecast 2025-2033

The Saudi Arabia smart parking systems market size reached USD 51.03 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 221.20 Million by 2033, exhibiting a growth rate (CAGR) of 16.50% during 2025-2033.

Saudi Arabia Smart Parking Systems Market Overview

Market Size in 2024 : USD 51.03 Million

Market Size in 2033: USD 221.20 Million

Market Growth Rate 2025-2033: 16.50%

According to IMARC Group's latest research publication,"Saudi Arabia Smart Parking Systems Market Size, Share, Trends and Forecast by Component, Type, Application, and Region, 2025-2033", The Saudi Arabia smart parking systems market size reachedUSD 51.03 Millionin2024. Looking forward, IMARC Group expects the market to reachUSD 221.20 Millionby2033, exhibiting a growth rate(CAGR) of 16.50%during2025-2033.

Download a sample PDF of this report: https://www.imarcgroup.com/saudi-arabia-smart-parking-systems-market/requestsample

Three Growth Factors Driving the Saudi Arabia Smart Parking Systems Industry

- Rapid Urbanization and Rising Vehicle Ownership

Saudi Arabias cities are growing fast, with millions flocking to urban hubs like Riyadh and Jeddah, putting pressure on parking infrastructure. The surge in vehicle ownership, driven by a growing middle class and economic diversification, has made efficient parking solutions critical. Over 60% of the Kingdoms population now lives in urban areas, and vehicle numbers have climbed steadily, overwhelming traditional parking systems. This creates a demand for smart parking technologies that optimize space and reduce congestion. Government initiatives like Vision 2030 push for modern urban planning, encouraging investments in smart infrastructure. Companies like Smart Parking Limited are capitalizing on this, deploying sensor-based systems in commercial complexes to manage high vehicle volumes, easing the strain on crowded city centers.

- Government-Led Smart City Initiatives

Saudi Arabias Vision 2030 is a game-changer, fueling smart city projects like NEOM and Qiddiya that prioritize cutting-edge infrastructure. The government is investing heavily in smart parking systems to support these ambitious developments, aiming to enhance urban mobility and sustainability. For instance, the Ennis Smart Parking initiative, backed by public-private partnerships with companies like Cisco, showcases how integrated traffic management can streamline parking. These schemes mandate advanced technologies, such as IoT sensors and real-time data platforms, to improve efficiency. With tourism booming115.9 million visitors in 2024smart parking is vital for handling increased traffic at airports and tourist sites, ensuring seamless experiences. This government push is driving companies to innovate and deploy scalable solutions across the Kingdom.

- Technological Advancements in IoT and AI

The rise of IoT and AI is transforming Saudi Arabias smart parking industry by enabling real-time solutions and predictive analytics. IoT sensors, deployed in cities like Riyadh, provide instant parking availability data, cutting down search times and reducing CO? emissions by up to 40% per vehicle. AI-powered systems, like those from Siemens, predict parking demand, optimizing space usage in busy areas like commercial complexes. These technologies are supported by Saudi Arabias focus on digital transformation, with investments in connectivity infrastructure boosting adoption. For example, cloud-based platforms from companies like Swarco AG allow centralized parking management, improving user experience. As digital adoption grows, with Saudi women leading global mobile shopping trends, app-based parking solutions are gaining traction, further driving industry growth.

Three Emerging Trends in the Saudi Arabia Smart Parking Systems Market

- AI-Powered Predictive Parking Analytics

AI is revolutionizing smart parking in Saudi Arabia by forecasting demand and optimizing space. Systems like those from Kapsch TrafficCom use AI to analyze traffic patterns, helping drivers find spots faster in busy areas like Jeddahs commercial districts. This tech reduces congestion and saves time, with studies showing up to 30% less parking search time in AI-equipped lots. In tourist-heavy cities, where 29.7 million inbound visitors arrived in 2024, predictive analytics ensures parking availability at key sites. Companies are integrating these systems with mobile apps, letting users reserve spots in real-time. This trend aligns with Saudi Arabias digital push, making parking smoother and supporting Vision 2030s goal of efficient, tech-driven urban ecosystems.

- Contactless and Mobile Payment Solutions

Contactless parking systems are gaining ground in Saudi Arabia, driven by the countrys high smartphone penetration and digital retail boom. Mobile apps like those from Get My Parking allow drivers to pay and locate spots without physical kiosks, cutting wait times by up to 20% in busy areas like airports. With Saudi women leading global mobile shopping, these apps are tailored for convenience, offering seamless transactions. Companies like Orbility are partnering with payment providers like CCV to integrate secure, contactless terminals, enhancing user experience. This trend supports Saudi Arabias cashless economy push, with digital platforms streamlining parking for the 115.9 million tourists visiting in 2024, ensuring quick, hassle-free access to parking at major hubs.

- Integration with Electric Vehicle Infrastructure

As Saudi Arabia embraces electric vehicles (EVs), smart parking systems are integrating EV charging stations to meet growing demand. Parking facilities in Riyadh and NEOM are equipping spaces with IoT-enabled chargers, allowing drivers to locate and reserve spots with charging capabilities. This supports the Kingdoms sustainability goals, with smart systems reducing energy use by 18,000 kWh annually compared to traditional lots. Companies like Robert Bosch GmbH are rolling out solutions combining parking guidance with EV charging, catering to the rising EV market. With government incentives for green tech under Vision 2030, this trend is set to grow, ensuring parking systems align with eco-friendly urban mobility and appeal to environmentally conscious drivers.

We explore the factors driving the growth of the market, including technological advancements, consumer behaviors, and regulatory changes, along with emerging Saudi Arabia smart parking systems markettrends.

Saudi Arabia Smart Parking Systems Industry Segmentation:

The report has segmented the market into the following categories:

Component Insights:

- Hardware

- Pucks

- Cameras and LPRs

- Smart meters

- Signage

- Parking gate

- Software

- Parking guidance system

- Analytics solution

- Service

- Consulting services

- Engineering services

- Mobile app parking services

Type Insights:

- On-street Parking

- Off-street Parking

- Garage

- Lot

Application Insights:

- Commercial

- Government

- Transport Transit

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Future Outlook

The Saudi Arabia smart parking systems market is poised for explosive growth, driven by Vision 2030s focus on smart cities and sustainability. With urban populations swelling and 115.9 million tourists in 2024, demand for efficient parking will soar, particularly in hubs like Riyadh and NEOM. Innovations like AI analytics, contactless payments, and EV-integrated systems will dominate, with companies like Siemens and Smart Parking Limited scaling up deployments. Government investments in digital infrastructure and public-private partnerships, such as the Ennis initiative, will accelerate adoption. As mobile app usage grows, especially among tech-savvy Saudis, user-friendly platforms will enhance accessibility. Sustainability will remain key, with smart systems cutting emissions by up to 40% per vehicle, aligning with the Kingdoms green goals and setting a global benchmark for urban mobility.

Research Methodology:

The report employs a comprehensive research methodology, combining primary and secondary data sources to validate findings. It includes market assessments, surveys, expert opinions, and data triangulation techniques to ensure accuracy and reliability.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the worlds most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145