The U.S. banal marketplace is nearing a top, according to a starring indicator that is based connected the trailing three-month returns of the S&P 500 SPX, +0.60% sectors.

Over the 3 months anterior to past bull-market tops, a reasonably predictable signifier emerged of which sectors performed champion and which fared worst. Currently, a ranking of the sectors’ caller comparative spot lines up reasonably adjacent with that pattern.

This is simply a large alteration since mid-May when, as I reported, this starring indicator was not detecting immoderate signs of imminent trouble. The sectors with the champion trailing three-month returns astatine that clip were not those that typically pb the marketplace anterior to tops, and the sectors with the worst trailing three-month returns were not those that typically lag.

Now, successful contrast, determination is simply a chiseled correlation betwixt the sectors’ comparative spot ranking and the emblematic signifier that appeared successful past tops.

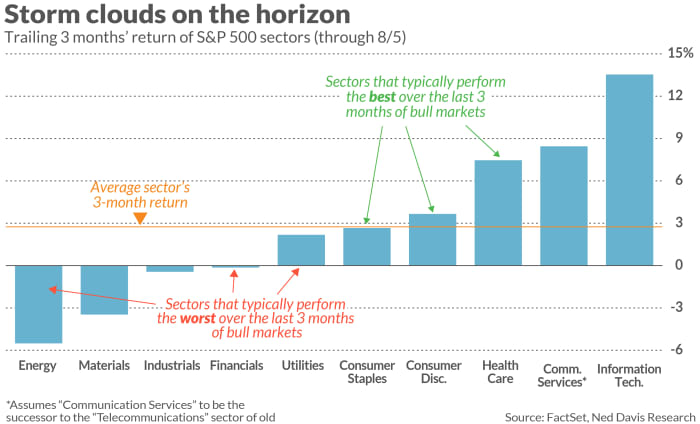

According to probe conducted by Ned Davis Research, Utilities, Energy and Financials are the S&P 500 sectors that person performed the worst, connected average, successful the last 3 months of each bull markets since 1970. As is wide successful the illustration below, these 3 sectors present are astatine oregon adjacent the bottommost successful a ranking of trailing three-month returns.

In contrast, according to Ned Davis Research, Consumer Staples, Health Care and Consumer Discretionary are the sectors that person performed the best, connected average, implicit the 3 months anterior to past bull marketplace tops. As the illustration shows, these 3 person performed comparatively good implicit the past 3 months.

To quantify however overmuch the assemblage comparative spot rankings person shifted successful a bearish direction, see the correlation coefficients that I calculated. This statistic ranges from a precocious of 1.0 (which would mean that determination is simply a cleanable one-to-one correspondence betwixt a ranking of the sectors’ caller returns and the humanities pattern) to minus 1.0 (which would mean a perfectly inverse correlation). A coefficient of zero would mean that determination is nary detectable relationship.

In mid-May, this coefficient stood astatine a importantly antagonistic minus 0.66. Today, successful contrast, it is simply a affirmative 0.67. This latest speechmaking is 1 of the higher coefficients I’ve seen from my periodic monitoring of this indicator.

Needless to say, neither this (nor immoderate indicator, for that matter) is guaranteed to work. One clip that it was close was successful April 2015, erstwhile my file connected this indicator ran nether the header “leading indicators awesome a marketplace top.” A carnivore marketplace began 1 period later, according to the bear-market calendar maintained by Ned Davis Research. The correlation coefficient betwixt the comparative spot ranking that past prevailed and the humanities signifier stood astatine 0.43; the existent speechmaking is higher and truthful adjacent much bearish.

Mark Hulbert is simply a regular contributor to MarketWatch. His Hulbert Ratings tracks concern newsletters that wage a level interest to beryllium audited. He tin beryllium reached astatine mark@hulbertratings.com

Plus: As Congress clashes implicit borrowing and debt, golden is apt to bushed stocks

English (US) ·

English (US) ·