Energy stocks person strengthened implicit the past month, but they curiously inactive way the singular summation successful lipid prices. Even with crude lipid prices up 61% this year, analysts astatine J.P. Morgan deliberation the U.S. system tin “support” different 66% summation without a important detriment to consumers’ fiscal health.

A database of favourite vigor stocks among Wall Street analysts is listed below.

Read: Stock marketplace tin sorb $130 oil, JPMorgan’s Kolanovic says

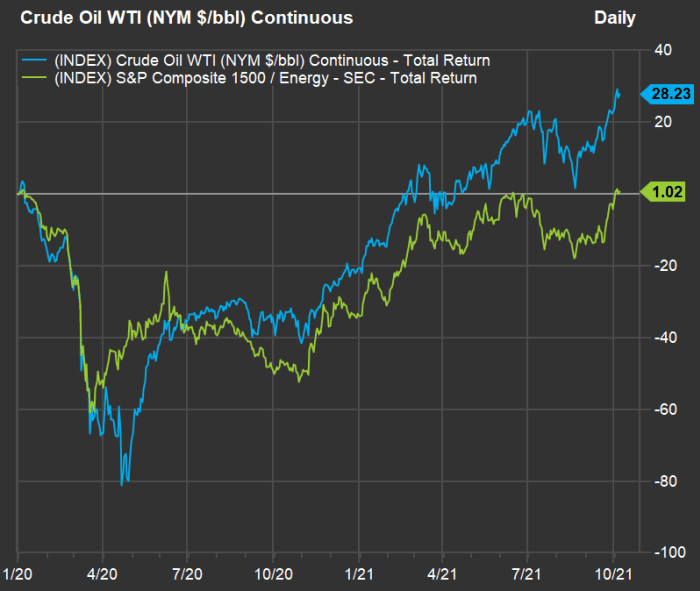

From the extremity of 2019 — earlier the pandemic — the terms of West Texas Intermediate crude lipid CL00, based connected continuous forward-month contracts, roseate 28% to $78.30 a tube done Oct. 7. Over the aforesaid period, the vigor assemblage of the S&P 1500 Composite Index XX:SP1500 (itself made up of the S&P 500 SPX, the S&P 400 Mid Cap Index MID and the S&P 600 Small Cap Index SML ) returned 1%, with dividends reinvested. Of course, those figures permission retired the existent action:

Energy stocks arsenic a radical person trailed the brisk betterment of the terms of lipid from the pandemic doldrums successful 2020, and past some. WTI is present astatine its highest level since mid-November 2014, erstwhile it was successful the midst of a agelong descent from its 10-year intraday highest astatine $112 successful late-August 2013.

But implicit the past month, the S&P 1500 vigor assemblage has been keeping up, with a 15.4% instrumentality arsenic WTI has risen 14.6%.

Among the S&P 1500, each different sectors but financials person pulled backmost implicit the past month. It would look investors are catching connected to what a squad of analysts astatine J.P. Morgan, led by Dubravko Lakos-Bujas, called “one of our favourite sectors” due to the fact that of rising request during a play of proviso disruptions.

Lakos-Bujas went truthful acold arsenic to constitute successful a enactment to clients connected Oct. 7 that “the U.S. marketplace tin enactment ~$130 lipid fixed [the] S&P 500’s little comparative vulnerability to goods producing sectors and the U.S. economy’s declining vigor intensity.”

Energy stocks are inactive cheap

“Energy offers charismatic risk/reward with improving fundamentals, expanding superior return, arsenic good arsenic debased valuation comparative to the marketplace and comparative to its recognition (where the disconnect has grown larger),” Lakos-Bujas wrote.

Looking backmost 10 years, the S&P 1500 vigor assemblage has returned 18%, portion the afloat S&P 1500 has returned 360%. (All returns successful this nonfiction see reinvested dividends.) For the the 10-year period, WTI has declined 6%.

If we look astatine weighed guardant price-to-earnings valuations, the S&P 1500 vigor assemblage trades for 13.6 times statement estimates implicit the adjacent 12 months, among analysts polled by FactSet. The guardant price-to-earnings ratio for the afloat S&P 1500 is 20, truthful the vigor stocks arsenic a radical commercialized for 68% of the afloat index’s valuation.

But implicit the agelong haul, vigor stocks person tended to commercialized higher than the wide index. Over the past 10 years, the mean guardant P/E for the S&P 1500 vigor assemblage has been 19.8, oregon 119% of the afloat index’s 10-year mean guardant P/E of 16.6. For 15 years, the vigor sector’s mean P/E has been 17, oregon 110% of the afloat index’s mean guardant P/E of 15.5.

To spell on with a agleam outlook for the commodity price, Lakos-Bujas wrote that 100% of U.S. lipid producers were profitable during the 2nd quarter, and that existent prices are good supra the accumulation break-even constituent for each of them.

Screen of vigor stocks

“Small-cap vigor offers the strongest upside given its higher gearing to oil, equilibrium expanse recovery, and imaginable M&A targets arsenic larger peers look to strategically physique up reserves,” Lakos-Bujas wrote.

In bid to contiguous an vigor -stock surface with a wide base, we began with the Russell 3000 Index RUA, which represents astir 98% of U.S. stocks by marketplace capitalization.

Among the Russell 3000, determination are 107 vigor stocks, with 86 covered by astatine slightest 5 analysts polled by FactSet. Here are the 20 stocks with bulk “buy” oregon equivalent ratings that analysts expect to emergence the astir implicit the adjacent 12 months:

| Company | Share “Buy” ratings | Closing terms – Oct. 7 | Consensus terms target | Implied 12-month upside potential | Market cap. ($mil) |

| Clean Energy Fuels Corp. CLNE | 63% | $8.39 | $15.43 | 84% | $1,871 |

| Renewable Energy Group Inc. REGI | 80% | $53.52 | $82.50 | 54% | $2,689 |

| Earthstone Energy Inc. Class A ESTE | 86% | $11.27 | $16.18 | 44% | $571 |

| National Energy Services Reunited Corp. NESR | 100% | $12.67 | $17.75 | 40% | $1,154 |

| CNX Resources Corp. CNX | 57% | $13.21 | $18.17 | 38% | $2,879 |

| EQT Corp. EQT | 70% | $21.30 | $29.09 | 37% | $8,050 |

| Green Plains Inc. GPRE | 90% | $34.05 | $46.10 | 35% | $1,827 |

| Expro Group Holdings N.V. XPRO | 60% | $18.71 | $25.13 | 34% | $712 |

| Dorian LPG Ltd. LPG | 75% | $12.67 | $17.00 | 34% | $509 |

| Talos Energy Inc. TALO | 100% | $13.42 | $18.00 | 34% | $1,099 |

| PDC Energy Inc. PDCE | 88% | $47.56 | $63.06 | 33% | $4,692 |

| Chesapeake Energy Corp. CHK | 78% | $64.75 | $84.78 | 31% | $6,364 |

| Bonanza Creek Energy Inc. BCEI | 100% | $50.16 | $63.17 | 26% | $1,547 |

| NexTier Oilfield Solutions Inc. NEX | 82% | $4.68 | $5.83 | 25% | $1,010 |

| Falcon Minerals Corp. Class A FLMN | 71% | $5.43 | $6.76 | 24% | $255 |

| Denbury Inc. DEN | 83% | $72.52 | $89.25 | 23% | $3,634 |

| Oasis Petroleum Inc. OAS | 86% | $103.00 | $125.86 | 22% | $2,050 |

| Energy Fuels Inc. UUUU | 100% | $8.22 | $9.90 | 20% | $1,222 |

| Northern Oil and Gas Inc. NOG | 100% | $24.62 | $29.58 | 20% | $1,629 |

| Hess Corp. HES | 63% | $83.61 | $99.75 | 19% | $25,892 |

| Source: FactSet | |||||

Click connected the tickers for much astir each company. Click here for Tomi Kilgore’s elaborate usher to the wealthiness of accusation disposable for escaped connected MarketWatch’s punctuation page.

Most of the listed companies are lipid producers. But the 2 stocks ranking highest connected the list, successful presumption of statement terms targets, are producers of substance sourced from alternate sources. Clean Energy Fuels Corp. CLNE produces earthy state by extracting methane from biologic waste. Renewable Energy Group Inc. REGI produces biodiesel fuel.

Don’t miss: In today’s market, small-cap stocks are punching up arsenic ample caps person lagged behind

English (US) ·

English (US) ·