Tofu and Tempeh Market: Plant-Based Protein Sources Gaining Global Momentum

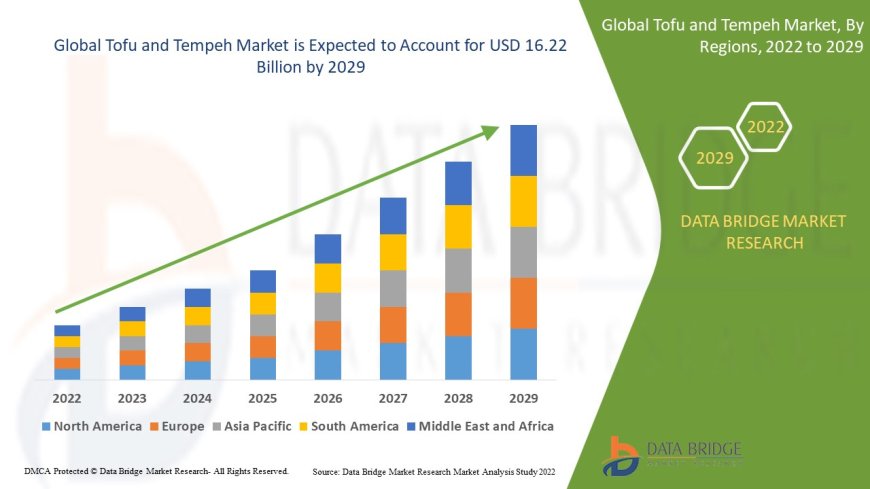

Tofu and tempeh market which was valued at USD 5.12 billion in 2021 is expected to reach the value of USD 16.22 billion by 2029, at a CAGR of 15.50% during the forecast period of 2022-2029.

Introduction

The tofu and tempeh market is witnessing remarkable growth as consumers increasingly shift toward plant-based diets. With growing concerns about sustainability, health, and animal welfare, tofu and tempeh have emerged as staple protein sources in vegetarian and vegan nutrition. Derived from soybeans, both products are rich in protein, calcium, and essential nutrients. Their versatility, affordability, and clean-label profile contribute to their growing popularity across developed and developing economies alike.

Tofu is a soft, curd-like product created by coagulating soy milk and pressing the resulting curds into solid blocks. Tempeh, in contrast, is made from fermented soybeans, resulting in a denser, nuttier product with higher fiber content. Both foods are central to Asian cuisines and are now increasingly incorporated into Western diets, restaurant menus, and convenience food segments.

As more consumers adopt flexitarian and vegan lifestyles, demand for high-quality, plant-based proteins is on the rise. Tofu and tempeh serve as ideal meat substitutes due to their texture, nutritional value, and culinary adaptability. Their growing inclusion in meal kits, ready-to-eat foods, and foodservice channels is driving market expansion.

Source:https://www.databridgemarketresearch.com/reports/global-tofu-and-tempeh-market

The Evolution

Tofu and tempeh have deep roots in traditional Asian diets. Tofu originated in ancient China over 2,000 years ago and later spread across Asia. It became a dietary staple in countries such as Japan, Korea, Thailand, and Vietnam. Its neutral flavor made it a preferred protein base for both savory and sweet dishes.

Tempeh has its origins in Indonesia, where it has been consumed for centuries. It is traditionally made through natural fermentation, enhancing the digestibility of soybeans and improving their nutritional profile. Historically used in rural areas, tempeh gradually gained recognition in urban markets due to its rich taste and health benefits.

During the 20th century, tofu entered Western markets through Asian immigrants and macrobiotic diets. It gained traction among vegetarians, health enthusiasts, and those with lactose intolerance. The commercialization of tofu in Western grocery stores began in the 1970s, with tempeh entering mainstream markets in the following decades.

In recent years, the demand for soy-based protein alternatives has surged amid rising veganism, environmental awareness, and innovations in food processing. Modern production methods have improved the consistency, shelf life, and scalability of tofu and tempeh. Moreover, fermentation techniques have advanced, leading to better flavor development and nutritional enhancements.

Market Trends

Soaring demand for plant-based protein alternatives

Expansion of tofu and tempeh in mainstream retail and foodservice

Growth of organic, non-GMO, and clean-label soy products

Increased popularity of Asian cuisines in Western markets

Rising consumer interest in gut-friendly fermented foods

Inclusion of tofu and tempeh in functional and fortified food segments

Product innovations including flavored, smoked, and pre-marinated versions

Launch of ready-to-eat meals featuring tofu and tempeh

Availability of frozen and shelf-stable tofu/tempeh formats

Vegan and vegetarian product positioning in supermarkets

Online sales and direct-to-consumer tofu and tempeh deliveries

Growing number of soy-free alternatives to cater to allergic consumers

Use of tofu and tempeh in high-protein snacks and on-the-go foods

Expansion into meal kits and subscription-based vegan offerings

Focus on eco-friendly packaging and sustainable sourcing

Marketing campaigns promoting tofu/tempeh for fitness and weight loss

Adoption in fast-food chains and plant-based restaurant menus

Regional fusion dishes incorporating tofu and tempeh creatively

Educational initiatives around the health benefits of soy

Diversification of protein sources in response to food insecurity

Challenges

Consumer perception of bland taste, particularly for tofu

Concerns about soy allergies and hormonal effects of soy

Short shelf life for fresh tofu and tempeh products

Lack of familiarity with tempeh in many non-Asian regions

Price volatility of soybeans due to global supply disruptions

Limited availability of organic and non-GMO soybeans in some regions

Competition from other plant-based proteins such as pea, lentil, and chickpea

Cultural stigma and dietary resistance in some demographics

Need for refrigeration during transportation and storage

Variations in product quality across brands and regions

High cost of premium or value-added variants

Challenges in scaling traditional fermentation processes

Misconceptions about genetically modified soy

Inconsistent labeling and certifications in international markets

Impact of anti-soy lobbying and misinformation campaigns

Lack of promotional efforts in conventional retail environments

Operational inefficiencies among small-scale producers

Challenges in flavor development for mass-market appeal

Dependency on import channels in certain countries

Concerns about deforestation linked to conventional soy farming

Market Scope

By Product Type

Plain tofu

Silken tofu

Firm tofu

Flavored tofu

Tempeh blocks

Smoked tempeh

Marinated tempeh

Tempeh burgers and crumbles

Fermented tofu

Organic tofu and tempeh

By Source

Conventional soy

Non-GMO soy

Organic soy

Soy-free plant protein blends (emerging segment)

By Distribution Channel

Supermarkets and hypermarkets

Health food stores

Online retailers

Convenience stores

Foodservice and HoReCa

Specialty and ethnic stores

Meal kits and subscription services

By Application

Household consumption

Restaurants and cafs

Catering services

Institutional meals (schools, hospitals, etc.)

Ready-to-eat meals

Plant-based product manufacturing

Snacks and protein bars

Baby food and senior nutrition

Functional food development

Private label food production

By End User

Vegetarians and vegans

Flexitarians

Health-conscious consumers

Fitness and bodybuilding enthusiasts

Individuals with lactose intolerance

Sustainable and ethical shoppers

Institutional food buyers

Ethnic food lovers

Nutrition-focused households

Food technologists and R&D centers

By Region

North America

Europe

Asia-Pacific

Latin America

Middle East and Africa

Asia-Pacific remains the largest producer and consumer due to traditional consumption patterns. North America and Europe are showing rapid growth fueled by the plant-based revolution. Latin America and the Middle East are emerging markets with potential in vegan and halal-certified foods.

Market Size

The global tofu and tempeh market was valued at USD 7.2 billion in 2024 and is projected to reach USD 13.4 billion by 2030, growing at a compound annual growth rate (CAGR) of 10.8%. The increasing demand for alternative proteins, coupled with expanding distribution networks and product innovation, is propelling this market forward.

Tofu represents the larger share due to its long-standing presence in both retail and foodservice channels. Tempeh, however, is the faster-growing segment due to rising awareness of its probiotic benefits and textural resemblance to meat. Both segments are benefitting from the increasing variety of applications, including snacks, meal kits, and frozen entrees.

The market growth is driven by urbanization, rising incomes, health concerns, and widespread vegan and flexitarian trends. Product differentiation, improved branding, and expanded availability through e-commerce are further accelerating market expansion.

Factors Driving Growth

Surging global demand for plant-based proteins

Growing prevalence of lactose intolerance and dairy allergies

Widespread acceptance of vegan and flexitarian diets

Health benefits associated with soy-based foods

Nutritional richness of tofu and tempeh (high in protein, fiber, and minerals)

Affordability compared to meat-based proteins

Increased consumer interest in fermented and functional foods

Expansion of clean-label and organic food trends

Government policies promoting plant-based consumption

Rising influence of social media and food influencers

Partnerships between producers and foodservice providers

Increased shelf life with frozen and packaged variants

Educational campaigns about the benefits of soy products

Innovation in recipes, flavors, and food pairings

Sustainable agriculture and reduced carbon footprint of soy production

Availability of tofu and tempeh in conventional retail stores

Increased investment in plant-based startups and product lines

Cultural globalization and popularity of Asian cuisines

Focus on protein diversification in response to climate change

Food security concerns driving interest in scalable protein sources

Conclusion

The tofu and tempeh market is undergoing a significant transformation driven by consumer demand for healthier, sustainable, and versatile plant-based protein sources. From their humble origins in Asian cuisines, tofu and tempeh have evolved into globally recognized superfoods catering to the modern, health-conscious consumer.

As manufacturers innovate with new flavors, packaging, and distribution strategies, the accessibility and appeal of tofu and tempeh are expanding. Despite challenges such as limited awareness, competition from alternative proteins, and logistical hurdles, the market is poised for robust growth.

Tofu and tempeh represent more than just meat substitutesthey are nutritional powerhouses with deep cultural roots and vast culinary potential. In a world increasingly focused on sustainability, health, and ethical consumption, these soy-based products are positioned to play a central role in the future of food.